Image by ArtTower from Pixabay

Comedian Chris D’Elia (I understand in the time since this post D’Elia has been exposed as an alleged pervert) was recently on Joe Rogan’s podcast. The pair discussed the longevity and resultant quality of TV shows. D’Elia made the point that a series can’t have more than six good seasons. (language warning).

There will be outliers. The exception to the rule, but most television that relies on an ever evolving story tends to run out of steam. In other words, they kept going too long. There will be multiple reasons to keep going. All financial. Pressure to keep people employed. Pressure by the networks to capitalise on the success by extending the premise. Financial incentives to the key creative minds.

Key creative minds may become less involved. Alternatively, they may struggle to bring new ideas to an old premise. Maybe they only envisioned a certain story arc and now they’re into uncharted and unneeded territory.

Given the number of shows that don’t make it beyond a pilot, or even get a second season, you can understand the temptation to keep an established name going. This guy claims only 20% of shows see a season 2. I’d say the best TV show I’ve seen is The Wire. For me, even the fifth season of The Wire was a letdown. I’d give it a 75% rating. The other four seasons were high 90’s. In that instance, there was no pressure or financial incentives to continue.

In 2005, HBO almost cancelled The Wire because its modest viewing figures couldn’t justify the $50 million it costs to make each series. The show was saved after Simon pitched the storylines for series four and five to Chris Albrecht, an HBO executive. Albrecht was so taken with Simon’s script ideas that he signed HBO up for two further series, even though they were unlikely to attract many new subscribers.

David Simon wasn’t running out of steam. HBO saw enough to keep going. There was even talk of a sixth season, revolving around the growth of the Hispanic population in Baltimore. The creators eventually decided they didn’t know enough about the subject. The cue went in the rack. Sensible.

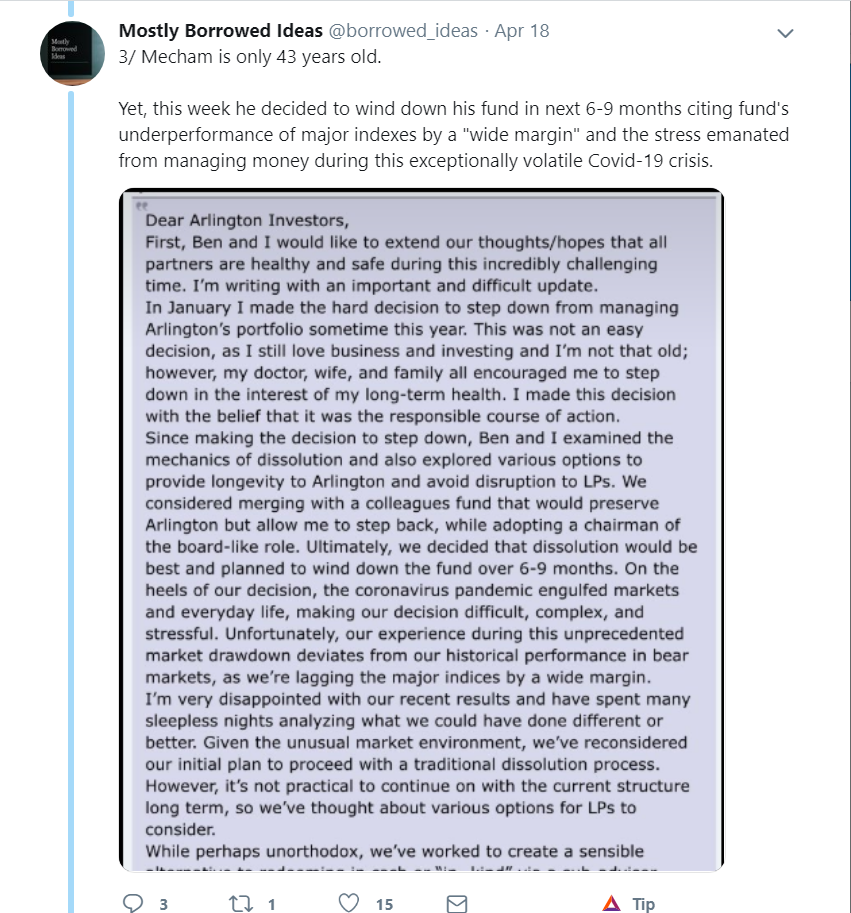

The COVID-19 crisis is already having big implications for asset managers. Longevity of some will be tested. They will be out of steam and the cue will go in the rack. On twitter, Mostly Borrowed Ideas highlighted Allan Mecham shutting down his fund

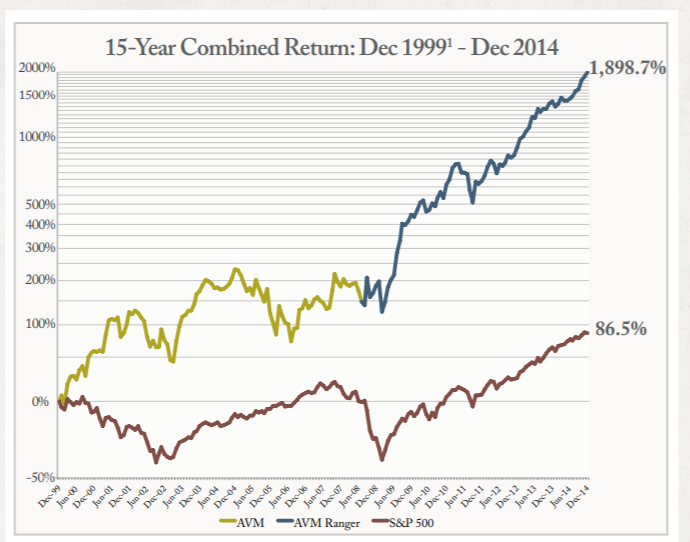

Why is this so interesting? Allan Mecham was anointed at one point as the next Warren Buffett. With his performance between 1999 and 2014, you can understand why.

It sounds like Mecham has been struggling recently with returns and his health. It’s no surprise the two could be intertwined. Returns affecting health. Health affecting returns.

Take a study on bereavement and investment management. Yes, there was a study done! From 1999 to 2013, 205 investment managers of 1195 actively managed funds were studied. On average the managers underperformed by 1.1% across a four-month period around the death of a parent. That underperformance also persisted for up to a year. The same underperformance wasn’t noted in index managers who suffered a parental loss.

And there were potential implications for everyone.

our findings suggest that individual investors may suffer a similar or even stronger impact when they experience sadness due to personal life events. The sum of these experiences is likely to generate substantial effects on their risk preferences as well as their investing performance.

I’ve seen a few funds boasting about picking the recent calamity. Some have snagged media coverage. It’s of no value for any investor. Don’t kid yourself. Yesterday has passed. For the fund, it’s worth boasting about. It helps with marketing. Hopefully more funds flow in. People buy into the message. The naive don’t know any better.

From there, it’s on. If you’re good enough to pick the top, surely you need to be good enough to pick the bottom, or any other event that comes along. Keep picking stocks that outperform while dodging the stinkers. You need to keep it up.

No one would turn down Allan Mecham like returns. How do you achieve them? First you have to find the manager. By the time you hear about them, can they keep it up? Mecham had an impressive track record. Until recently. And ‘until recently’ is not a knock on Mecham, it’s a commentary on human frailty. For reasons beyond his control, he ran out of steam. As Mostly Borrowed Ideas noted regarding the comparisons to Warren Buffett and Charlie Munger.

Buffett and Munger’s equanimity during market crisis or a long period of underperformance is perhaps impossible to match.

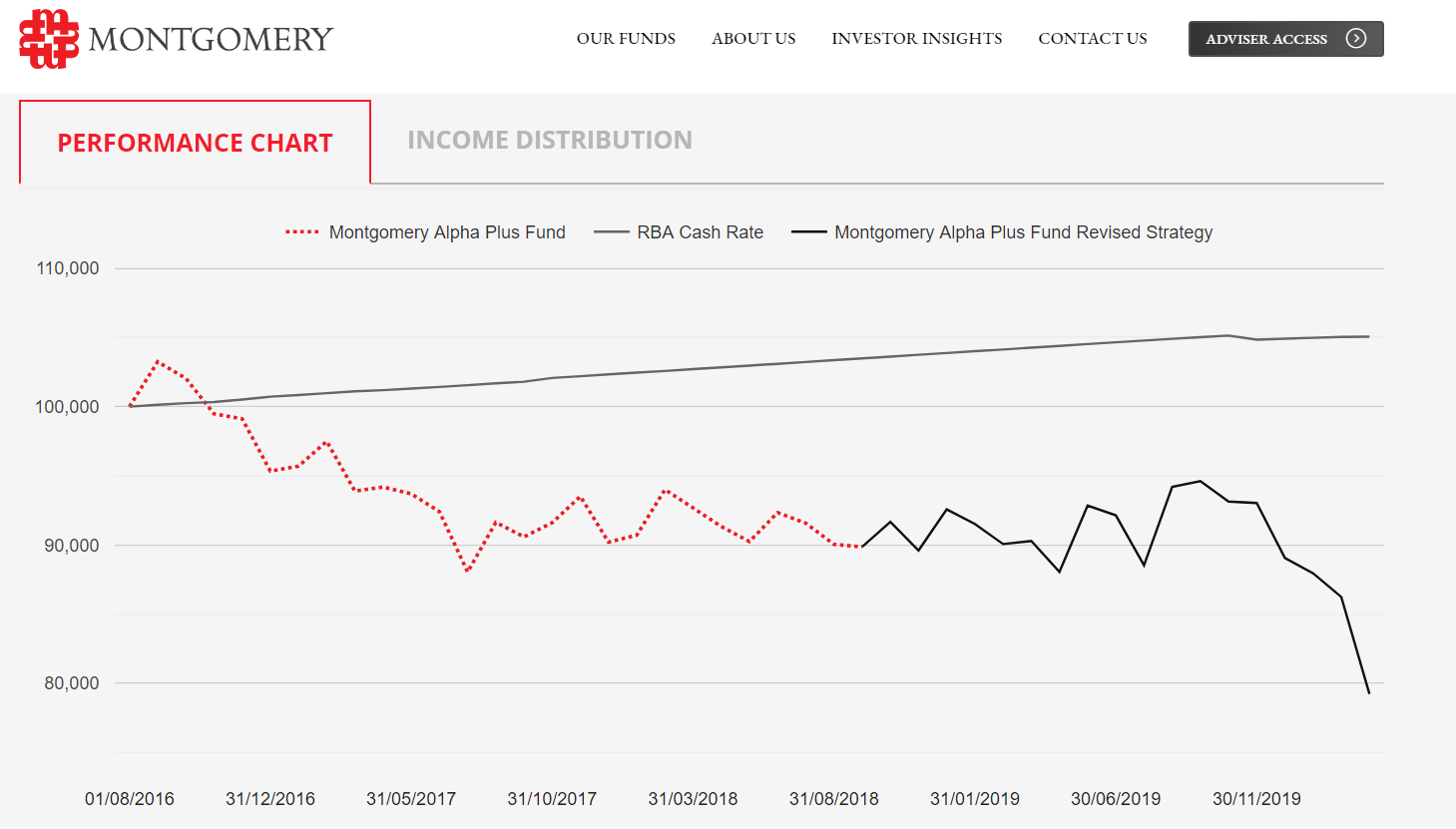

Some funds may not even have steam. The danger of jumping on a fund hoping to find the next outperformer? There was some sniggering on social media recently about the closure of Montgomery’s Alpha Plus fund. I’ll let the chart speak for itself.

From the fund’s fact sheet:

The Fund is benchmark unaware, which means the components of the portfolio and their weightings will have no regard to stock market indices. The Fund is also style and market capitalisation agnostic, which means it can invest in any compelling opportunities. AND

The Fund will typically aim to hold equal values of Long and Short positions across two portfolios. Long positions will be held in the “Long Portfolio” and Short positions in the “Short Portfolio.”

It all sounds very exciting. There’s one question, what the hell am I getting here? Buy/Sell spreads of 0.25%, a management fee of 1.55% and a performance fee of 17.94% outperformance above the RBA cash rate. I’ll ignore the temptation to take the obvious cheap shot about the outperformance fee not being required. Try explaining this fund to the average investor. Good luck.

I’m not here to pick on Montgomery. I look across their funds. Some are outperforming. Others aren’t. I imagine it’s a similar story across most fund managers. How could an adviser explain the stinkers like the Alpha Plus Fund to their clients?

Portfolio constructed from index trackers? Client is close to getting the benchmark. Nothing to explain. Portfolio constructed from the factor universe? Client might underperform short term. On available data, outperformance is likely to emerge long term. These are all explainable concepts.

There’s famous story about Dimensional’s first fund struggling badly for the first nine or ten years. At that point it was only institutional investors. The difference? DFA didn’t run out of steam. The evidence and the data behind the fund was solid. It wasn’t two guys randomly picking stocks for any compelling reason that came to mind. They persisted.

Whether using index trackers or factor funds, there’s an elimination of human variables. There’s no frailty. The people may change, but your funds are likely to exist in ten, twenty, thirty years time. They’ll still be managed according to a similar set of principles.

No chance of running out of steam.

This represents general information only. Before making any financial or investment decisions, I suggest you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Don’t make financial or investment decisions on the basis of blog post or sourcing advice from internet forums, if you’d like a introduction to investing, please consider reading Your Investment Philosophy, which offers an evidence based primer for building your own investment philosophy.