Month 27 of the discipline project and September 2022 was a pretty ruthless one. I’ve been in the habit of sending money to my investment account almost at the start of the month. The contribution was 1x and allocated to global small companies.

After the Fed did their thing we had a bit of a wild ride.

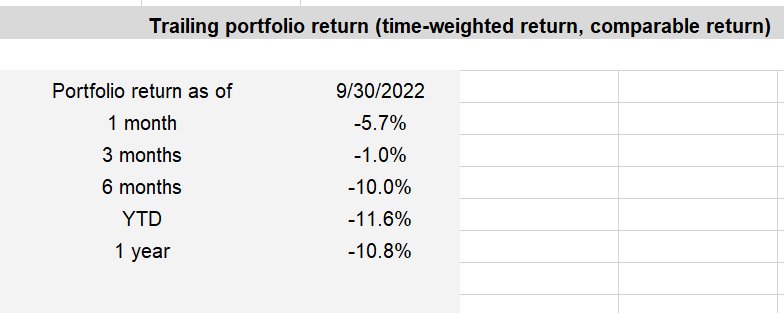

The performance figures are what they are. I’m not sure I’ve put up a pie of where the allocations are, but it’s currently about 28% in global value, 23% Australian high yield, 20% global large, 20% global small, 5% emerging markets, 4% Australian REITs.

The allocations to global value and Australian high yield have been the things that have stopped it turning really ugly. Had I not dumped the global aggregate bond fund this time last year and replaced it with Australian high yield shares, things would be considerably worse. It’s not suggesting I’m less risk, I’m taking more, but it was more switching correlations in a perverse moment when bond prices were only going one way. Even if high yield shares were kicked in the chompers, there was a potential 7-8% grossed up yield with franking credits to ease the pain. Being unhedged globally has also helped with the Australian dollar falling.

One of the benefits of having a lot of data available is having some understanding of value’s history. Now I don’t claim to be Fama or French, but looking through the data and seeing what value’s done when there’s been some inflation vs just being in the index is useful.

If you compare it to “just buy VDHG bro!” which is the catch all response from a lot of people online when offering investment advice, it’s been a better experience. If you were a Vanguard Diversified High Growth Index ETF bro, you’d be looking at an 18% decline YTD. Yes, the asset allocation is different and it has 10% in fixed interest, but you wonder how many self directed bros lose faith in times like this?

In contrast, and as an example, compare this with a 75% allocation to DFA Global Core unhedged and 25% to the ASX All Ords, which has returned -13.03% YTD, leaving 11.6% YTD looking not so bad. Again, a different construction as DFA core has 50% in Large, 30% in value and 20% in small, but it’s shown the value of value in this environment.

Until next month.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.