Month 28 of the discipline project and what a difference a month makes. Again, sent the standard 1x contribution to the portfolio at the beginning of the month which was allocated to MSCI World ex Australia. So I received the full heft of the market movement upward with that buy.

I also sold a portion of a stock I’ve been holding for several years, it’s up significantly over that time so I basically pulled the initial investment and have allowed it to free carry. Of that money, I sent 2.3x the standard monthly contribution, to the portfolio. Unfortunately, the time it takes to realise the money in one account and then the time it takes to send it to the other account, meant I didn’t enjoy the benefit of all the gains that were showered down during October. T+2 and another day waiting for a bank transfer meant missing about 4-5% in the first few days of the month.

You may have seen those “what if you miss the best 1, 2 or 3 days in the market” graphics. I guess that’s where they come from.

Anyway, 1x contribution went to Global Value and 1x went to Australian high yield. The rest I left in cash.

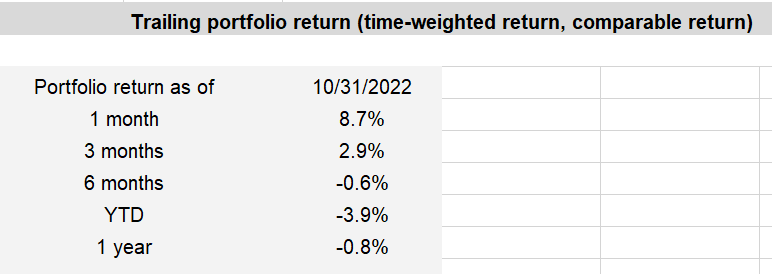

Here’s how things stand according to the boggleheads spreadsheet.

Given how rotten the year’s been for most, I’m certainly not complaining. I’ve been fortunate the Australian dollar has fallen, which has offered some protection as the global part of the portfolio is unhedged. I’ve also benefited from having almost 50% of the portfolio in Global value and Australian high yield. While the MSCI World ex Australia and MSCI World ex Australia small indexes have been belted, both Global value and the Australian High Yield shares index are pretty much where they started the year, factoring distributions they’re slightly up pre tax.

Until next month.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.