The first day of February and it was a full contribution, plus all the prior quarter’s distributions, put into global infrastructure.

I expect infrastructure will grow a little bit this year, not in terms of investment growth because I have no idea about that, but in terms of size in the portfolio. I expect the combination of emerging markets, infrastructure and Australian REITs will eventually sit around 25% of the portfolio.

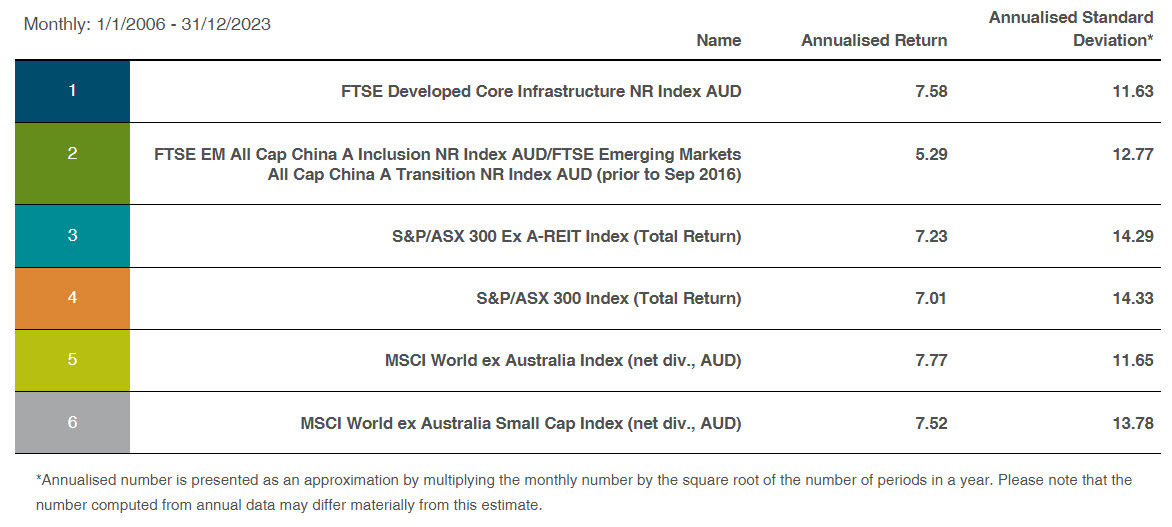

Are they diversifiers? Do they lower portfolio volatility. Yes, if you combined the following into a portfolio with 24% in those noted asset classes above, vs something like a VAS/VGS split 40/60, the standard deviation is slightly lower. The return is also slightly lower, which you should expect, but if you’re combining various asset classes you’d hope they perform differently and drop portfolio volatility.

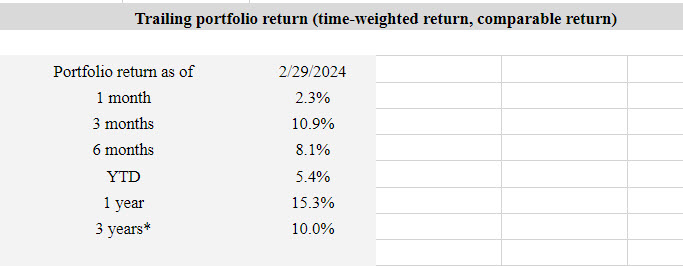

As far as returns, February was another decent month. Outstanding really. You get 2.3% each month, and at the end of the year you should be laughing. As we all know it’s not quite that easy.

As far as returns, February was another decent month. Outstanding really. You get 2.3% each month, and at the end of the year you should be laughing. As we all know it’s not quite that easy.

I won’t hold my breath expecting more because I always assume a zero return each year as a best case scenario. Obviously you hope it will always be better, and you hope it will never be worse. Either way, it’s just a matter of what you finished with, adding on your expected savings and being content with the addition.

Until next month!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. If you’re a high net worth individual looking for financial advice, you should consider a high net worth financial adviser who can thoroughly assess your circumstances and provide a holistic wealth planning solution.