Six months down, all contributions made as intended. Didn’t fall into the same trap as last month. Tried to put the money into the account and just place the trade. That happened. Again, it’s a situation where the inexperienced could find themselves lured by the seduction of market timing.

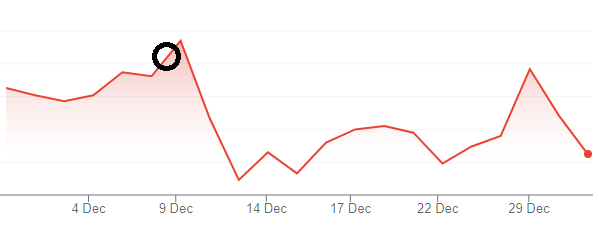

Below shows where I bought the MSCI World ex Australia fund for December. If only! On the flip side, both the MSCI World Small ex Aus and the Global Aggregate Bond Fund finished slightly up from my buy.

Being able to time the low of every month would be fantastic, but unrealistic.

Progress after contributions. These are cumulative.

Portfolio End July: -0.44%

Portfolio End August: 1.03%

Portfolio End September: 0.46%

Portfolio End October: -0.14%

Portfolio End November: 5.15%

Portfolio End December: 5.07%

There is another discipline issue not yet discussed. While I’ve only been focused on saving the contributions and executing the buys each month (come hell or high water), I’m also holding what you might term legacy individual stock positions. The goal is eventually to not hold any individual stocks. Some of these have done exceptionally well in 2020. One is up 400%. As I noted last month, I don’t consider this skill. It’s luck. That particular company I was essentially holding as a shell. New management arrived with a new project, while also running fresh eyes across an old project which suddenly had a multi-application use.

It looks very exciting, but I’ve also made 400% on my money. This is only based on a stronger and well known management team with a new project arriving. I also have that nagging question, ‘why didn’t you have more in the stock and shouldn’t you buy more?’ The reality? This is speculation, so I’m left balancing emotions. I didn’t have the information available to increase my holding before it went up 400%, so it’s pointless to lament that.

I look at it as a daisy chain. I have a job, which allowed me to save money. The savings allow me to use further savings to continually build this portfolio. The savings and this portfolio allow me to keep the legacy stock holdings for as long as I can.

Until next month.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.