Eight months down, all contributions made, but not as intended…

As mentioned last month, I was looking at including the FTSE Emerging Markets Index into the portfolio. Quite fortuitously, I didn’t. As I’d previously been bemoaning that my unintentional “accept the market price”, buy when you have the money strategy, seemed to top tick every monthly market high before a brief decline, it was nice to get one back. The emerging markets ETF that I bought was 8.5% off its high, so I took the 8.5% discount and included a 10% allocation to emerging markets.

This raises a couple of points.

Firstly, me being a moron means that my strategy has changed 9 months in. This is another example of why someone might need an adviser. You start off with a grand 10 year strategy and you’re questioning whether it’s actually right 9 months in. And yes, it’s partially performance related. I previously had 33.3% of the portfolio allocated to bonds, and as yields rise bond prices have been hammered. There has been the salve of the distributions, but these aren’t exactly useful from a tax perspective.

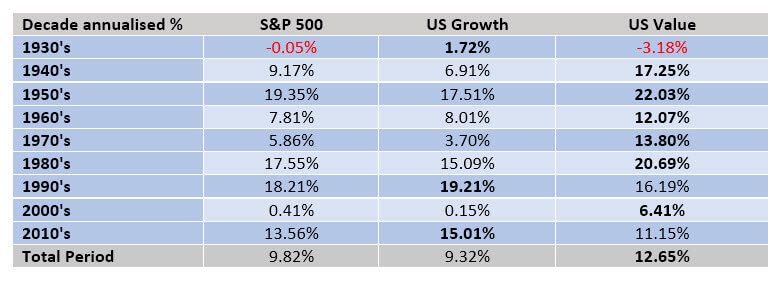

There was also the aspect of straight indexing. I’m a believer in value, despite it’s awful performance over the past decade. 30% of my retirement is in value and I haven’t abandoned it. I wrote this article last year and the charts speak for themselves. And across the decades.

While I’d also been watching emerging markets, I’d been sitting there watching a value ETF continually run on over the past 6 months and continually ignored it. From next month I expect I’ll be making some catch up allocations

Going forward, I expect it’s going to be more:

Global Large: 22.5%

Global Small: 22.5%

Global Value: 22.5%

Global Bonds: 22.5%

Emerging Markets: 10%

For anyone reading this, this exercise is in discipline. It was meant to be picking one thing and sticking to it, but it’s also important to remember to be fully prepared when you begin. I ploughed off into the distance with a simple idea, but realised I should have better considered my portfolio design in the beginning. Luckily, it was more efficient to add emerging markets in one hit. At this point the buy was 10% of the portfolio, which is the allocation I wanted. It was also the entire month’s allocation. Prior to this it would have been dinky little buys, so it actually works out. I figure I’ll allocate to emerging markets now on a half yearly basis. So the real oversight was ignoring value. Again, something that wouldn’t have been missed had I been working with an adviser.

The other thing to remember, I’m adding diversification in emerging markets, which will behave differently to developed markets and a value tilt, which is an expectation of higher returns over the long term. Despite the fact I wasn’t fully prepared at the start, I am adding additional allocations with legitimate reasons. This is in contrast to hearing about some fund and patchworking it onto your portfolio, then in ten years having 17 different funds without any understanding of why they are there in the first place.

Progress after contributions. These are cumulative.

Portfolio End July: -0.44%

Portfolio End August: 1.03%

Portfolio End September: 0.46%

Portfolio End October: -0.14%

Portfolio End November: 5.15%

Portfolio End December: 5.07%

Portfolio End January: 4.95%

Portfolio End February: 3.94%

Portfolio End March: 6.72%

Until next month!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.