Despite being quite undisciplined when it comes to updating this website, the intended investment discipline rolls along on its merry way.

Let’s catch up.

Over the past year things have changed. In the last post at the 12 month mark I’d noted a few things like bonds will stink when rates rise and that I’d included global value and emerging markets. At the 16 month mark I booted the global aggregate bond fund. There was only way for bond prices to go and I didn’t fancy sitting on longer term bonds with anemic distributions and zero ability to lower volatility in the current environment.

That part of the portfolio went to the boomer’s favourite: an Australian high yield index. Yes, it will be volatile with around 60 holdings, but I figured being in the situation bonds were I had to forgo the pretense they were anything other than a high risk short term hold.

This leaves me with a portfolio that is 100% equities. Something that hasn’t proven favourable over the past 6 months, although the Australian high yield index was the most stable part of the portfolio over that period. And it would have been a worse result holding bonds. Is 100% equities smart? Personally I know I can handle the volatility and I’m making monthly contributions, so it’s a “we’re buying on discount” theory if things keep getting flogged and I have long service leave accrued at work. If I ever get tapped on the shoulder I won’t be scratching around for cash, but I do maintain other savings.

Where do we sit?

First Discipline and holding breakdowns.

MSCI World Ex Australia: 22%

MSCI World Small Ex Australia: 21.5%

Australian High Yield: 22%

Emerging Markets: 6.5%

Global Value: 27%

The rest sits in cash.

I started with a monthly figure that I contribute, I won’t name it, but what I can bear to save and contribute and I’ve been pretty successful at repeatedly hitting it. We know I had every contribution in the first 12 months, so let’s look at the last 12. I’ll use the monthly contribution as 1 and if it’s half it’s 0.5 etc.

Month 13: 1

Month 14: 1

Month 15: 1

Month 16: 2

Month 17: 7.66

Month 18: 1

Month 19: 0.66

Month 20: 3.33

Month 21: 0

Month 22: 2

Month 23: 1

Month 24: 0.33

I’ve been pretty disciplined. There have been some lumpy parts where extra was contributed. I fell into “buy when you’ve got it” instead of smoothing it out, but being disciplined is also going with what has historically been known to work.

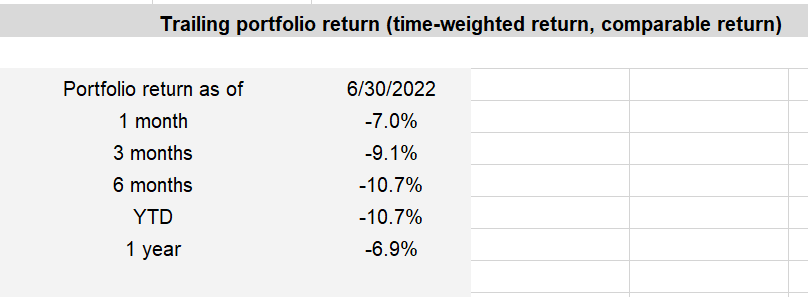

Returns are the ugly part, but this is about discipline. I’ll just take it straight out of the Bogleheads spreadsheet.

To me it’s “meh”. I understand other people who’d be retired don’t have the luxury to “meh”, but I’m not disappointed in those returns. They were always coming at some point. This is a ten year project, so the expectation is they look a lot better after 10 years.

And that’s that. Until next time.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.