Upfront, this post is for entertainment purposes only. I am a buffoon and nothing I mention here should be relied on for making any investment decision. It is backward looking, not feasible, and offers no indication of how any of these funds will perform in the future. I hold positions in every fund mentioned or their ETF equivalents. The data and calculations used were assumed to be correct at the time of publication, if they are not, refer to the reference of me being a buffoon.

The Entertainment

So there’s more to this than just Dimensional Global Core (Unhedged) and Vanguard VVLU. I’ve used VVLU, being the ETF’s code because I assume people will put the code in google and this might pop up. What I’m really discussing here are the following:

Dimensional Global Core Equity Trust (Unhedged)

Against a combination of

Vanguard International Shares Index Fund

Vanguard Global Value Equity Fund

Vanguard International Small Companies Index Fund

Why?

The Vanguard Global Value Equity Fund now has six years of monthly returns data as of 30 September 2022. I’ve been tracking this for a while and what I found I thought was interesting to share for entertainment purposes.

If you didn’t know, Dimensional are big into factors. Large, value, small, profitability, momentum, albeit they use momentum in a different way to others. Either way, they’re quite precise and do a lot of research to back up their beliefs. Their tagline now is “Beyond Indexing”.

Now if you’re confused with what I’m talking about, I’ve co-written a book where you might be able to learn a bit more because I can’t explain it all here. Your Investment Philosophy, it’s just over 100 pages, it’s $12 bucks, even cheaper on kindle. A couple of people have given it 5 stars. Thanks.

In DFA’s own words, the Dimensional Global Core Equity Trust (Unhedged) aims to:

To provide long-term capital growth by gaining exposure to a diversified portfolio of securities associated with approved developed markets (excluding Australia), with increased exposure to small companies and Value Companies relative to a Market Capitalisation Weighted portfolio.

Other things I’ve “been told” about this fund. Basically it exists in a construction of 50% large companies, 30% value companies and 20% small companies. Why? It saves needing to buy three separate funds to get factor exposure. No need to mix and match, the fund does the work for the investor. I’ve “been told” it’s regularly rebalancing, has a profitability overlay and the benefit of all of these factors under one hood should mean if a small company becomes large it doesn’t need to be sold off in your small fund and bought again in your large fund, so it should have the benefit of being more tax efficient.

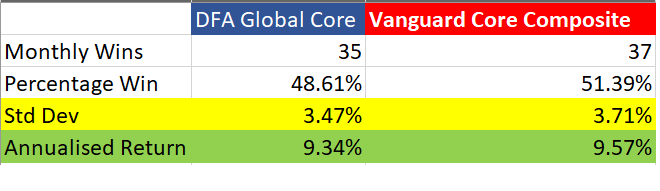

With these hearsay facts established, what would happen if DFA Global Core was lined up against a 50/30/20 combination of Vanguard’s International Shares Index Fund (Large), Vanguard Global Value Equity Fund (Value), Vanguard International Small Companies Index Fund (Small), which I will call the Vanguard Core Composite?

The following results are net of fees without any consideration for tax and the Vanguard option is essentially rebalanced on a monthly basis to account for the ongoing rebalancing of DFA Global Core equity.

Data Source: DFA Global Core is Dimensional Global Core Equity Trust Unhedged Class. Vanguard Core Composite is a construction of Vanguard International Shares Index Fund 50%, Vanguard Global Value Equity Fund 30%, Vanguard International Small Companies Index Fund 20% Rebalanced Monthly. Returns are net of fees. Time period: October 2016 – September 2022.

And the growth of a dollar (same data source/time period)

So it’s neck and neck in this experiment, but are there any conclusions to be drawn from this entertainment experiment?

No.

With everything like this, it’s not the real world. There’s some fascination that after six years the real fund and the hypothetical are in the same ball park, but who could achieve it? The immediate benefit DFA Global Core has over trying to replicate a similar construction with Vanguard is an investor can’t conceivably rebalance on a monthly basis to achieve this result. They’d blow their backside out with trading costs, taxes and probably frustration. So it’s not a victory for Vanguard.

The other thing, I think I recall DFA’s co-CEO Gerard O’Reilly say on the Rational Reminder podcast earlier in the year, to a question regarding PWL having built some constructions that replicate DFA type returns, that it’s not a like for like comparison. Don’t quote me on that being exact, but it’s true. If you x-ray DFA Global Core and this Vanguard Composite, they look different, it just happens they’ve had a similar performance over the time period measured.

I’m not going to delve too far into analysis here, lest I look like a monkey painting with his own poo. If someone more qualified than I wants to take a further look at this, then they can find the data. I’ve provided the initial idea.

Vanguard could build a fund like this, likely via the three funds, but what would be the take up? They already took their global multi-factor fund behind the woodshed because of a lack of investor interest, ironically just as it may have performed better and potentially attracted some investor interest. Vanguard does attract the “jUsT bUy ThE iNdEx, BrO!!!” mentality, to the detriment of their reasonably priced factor funds. In a terrible year, VVLU has stood up quite well while their large and small indexes have been smashed, and it’s the value component of DFA’s core (if you look at the stand alone DFA Global Value Trust) which has helped that fund do better than the index this year.

Like I said, don’t use this for investment decisions, I’m a moron, this result isn’t real life and will have no bearing on what happens in the future.

This represents general information only. Before making any financial or investment decisions, I suggest you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Don’t make financial or investment decisions on the basis of blog post or sourcing advice from internet forums, if you’d like a introduction to investing, please consider reading Your Investment Philosophy, which offers an evidence based primer for building your own investment philosophy.