Click video to listen to story.

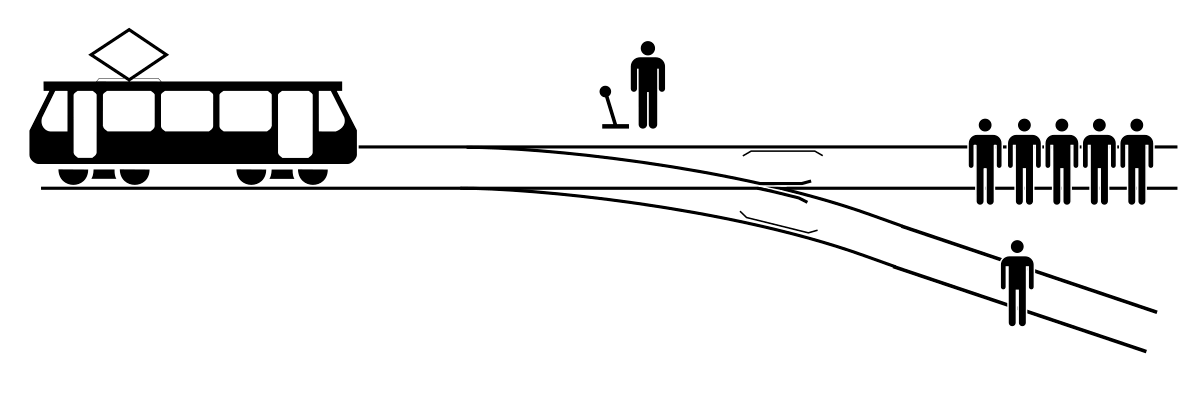

You’re out walking with your dog near a railway track. Behind you there’s a rumbling noise. Thundering down the track is a trolley, looking up ahead you can see the trolley is headed for a bridge with five workers on it. They will either be run over or jump to certain death. Beside you is a large switch. If you pull the switch, you will divert the trolley to a second track and another bridge. Only this bridge has a single worker on it who would face the same fate as the other workers.

What do you do? Pull the switch and save the five workers, dooming the one worker? Or take no action, saving the one worker, but dooming the five?

This dilemma which has many variants is known as the trolley problem and was introduced by philosopher Phillipa Foot in 1967. It poses a moral dilemma of choice when neither outcome is palatable. It might be a dilemma worth considering in the current climate of ESG investing. If you need a refresher, ESG stands for environmental, social and governance. The general consensus is ESG investing is about making more ethical choices with your investment dollars.

Read the full The Greys of Ethical Awareness post.

This represents general information only. Before making any financial or investment decisions, I suggest you consult a financial adviser to take into account your personal investment objectives, financial situation and individual needs. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Canberra’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.