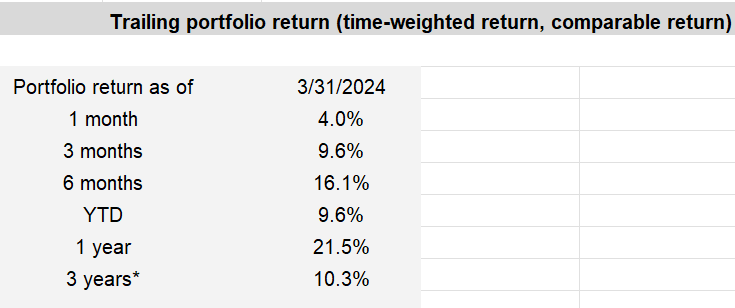

March was a pretty decent month, and it pushed the 1 year return above 20%. I split the contribution between global value and emerging markets. One of the issues when you have seven holdings, and three of them are around 5-7%, is they can feel a little unloved from time to time. They may lag behind and only receive a contribution every so often.

I don’t have anything automated set up that would just auto allocate to everything on a monthly dollar basis. That is how my superannuation account works, but I’m more hands on. It does have a benefit of keeping weightings more consistent. I keep my weightings of MSCI World ex Australia and MSCI World Small Companies ex Australia the same, which has meant pushing more money toward small as large keeps sprinting away.

I often wonder how many people stick more money into the underperforming parts of their portfolio, or does everyone just get carried away with their winners?

While I did cross a financial milestone back in January, I didn’t make much of it. It was one of those round numbers. It’s nice to see, but the more important part was being over a year ahead of when I was expected to reach that figure. Markets have been pretty good, although they were poor in 2022, proving you just need to keep pushing forward.

Until next month, stay disciplined!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. If you’re a high net worth individual looking for financial advice, you should consider a high net worth financial adviser who can thoroughly assess your circumstances and provide a holistic wealth planning solution.