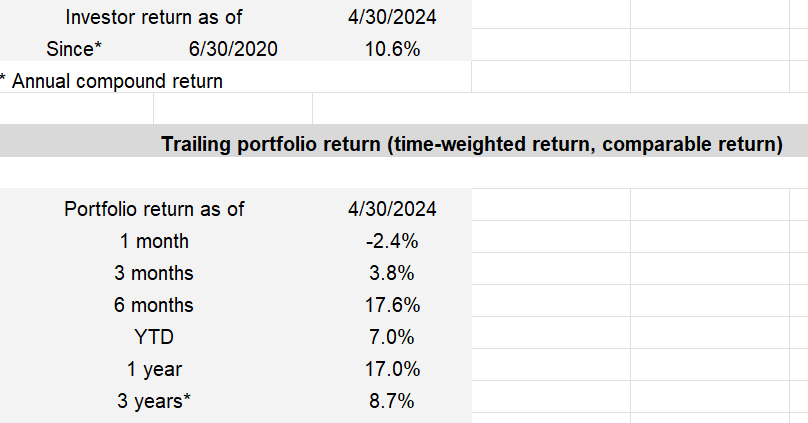

April was a down month, but also one where distributions came in. Which is somewhat handy if you get to reinvest them at a discount. Given they don’t arrive in the account until the 3rd week if the month has had a rough start it can work out in your favour.

The month’s actual contribution went towards the Australian high yield index at the start of the month, which promptly fell. When the distributions hit my account by the 18th I reinvested them into Global large which I’d been neglecting. When something is on an upward tear in a portfolio you’re quite often putting money into other things to keep target weights. Global large has been on a tear, so when it had a notable decline for the first time in 8 or 9 months I took some advantage. I won’t say I took too much advantage because had I just allocated more money there over the past year or so, it would still be cheaper that what it was this month.

This all highlights the mental gymnastics of running a custom portfolio with seven holdings. Nothing will ever perform the same, so every few months there will be a choice. When something has underperformed, well that’s easy. That’s where the money goes. When something is outperforming, it’s always a dilemma to add more and potentially overweight. I never do that, and when it comes to global large it’s been a cost to performance.

Until next month, stay disciplined!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. If you’re a high net worth individual in Australia looking for financial advice, you should consider a high net worth financial adviser who can thoroughly assess your circumstances and provide a holistic wealth planning solution.