“You’re telling me interest rates go up?”

The increase in interest rates has surprised and panicked a lot of peeps. Heading south for almost a decade in Australia, they’re basically back to where they were in 2013. Only they moved from almost zero, back to where they were in 2013 in seven months. Ouch.

I don’t have a mortgage so I’m not feeling any pain. My biggest adjustment has been switching from Pepsi Max to supermarket brand diet cola. On that, I can honestly say after a week or two you don’t even notice the taste difference any more. Otherwise I do wander around internet finance haunts and if they’re to be believed, some people are feeling it. A three to four figure adjustment to the budget in half a year is akin to a quick fist to the testies.

This post on ausfinance readdit caught my eye.

My partner and I make combined $150,000 and we have a morgage of $600,000. We are first home buyers and bought at the worst possible time in history (earlier this year)

We don’t like waiting around so we look up what the banks are expecting the terminal rate to be and increase our repayments to match it. Current estimates are 3.85 giving a 6.05 morgage rate.

It’s pretty crazy how expensive that is, it’s above our stress test thresholds and am pretty much saving nothing now.

I feel pretty unlucky to be a first home buyer at this time. Very jealous of all the people with paid off or paid down mortgages or lots of equity. Everyone wanting rates to go crazy high clearly don’t care about young people who are trying to get started.

I think we are going to rent out one of our bedrooms

What’s interesting about this is it still seems comfortable. Let’s just assume they’re both on 75k, the take home for the month should be around $9770. The repayments on the mortgage at 6.05% (already shifted payments there) are $3627 over 30 years. If they had kids they’d be mentioned. Obviously there’s council rates and insurance, set aside something for maintenance, maybe $1000 a month. So $5000 a month left for two people, after shelter.

They’ve had the luxury to shift their payments early to what they perceive as the worst case scenario. They have the luxury to consider renting out a bedroom. They have the luxury to save “pretty much nothing” after official rates move from 0.1% to a hypothetical 3.85%, when rates are currently at 2.85%.

After reading this I’m starting to wonder if some of the worst affected people will be those quite able to ride out an increase in interest rates. I make this point because these types of posts are popping up on finance forums. Those living according to personal finance rules that they’re temporarily unable to meet. Brains and spirits broken because they can’t exist independently of some arbitrary rule an anonymous person told them on the forum. Agonising over the fact their savings aren’t constantly ten, fifteen, twenty per cent.

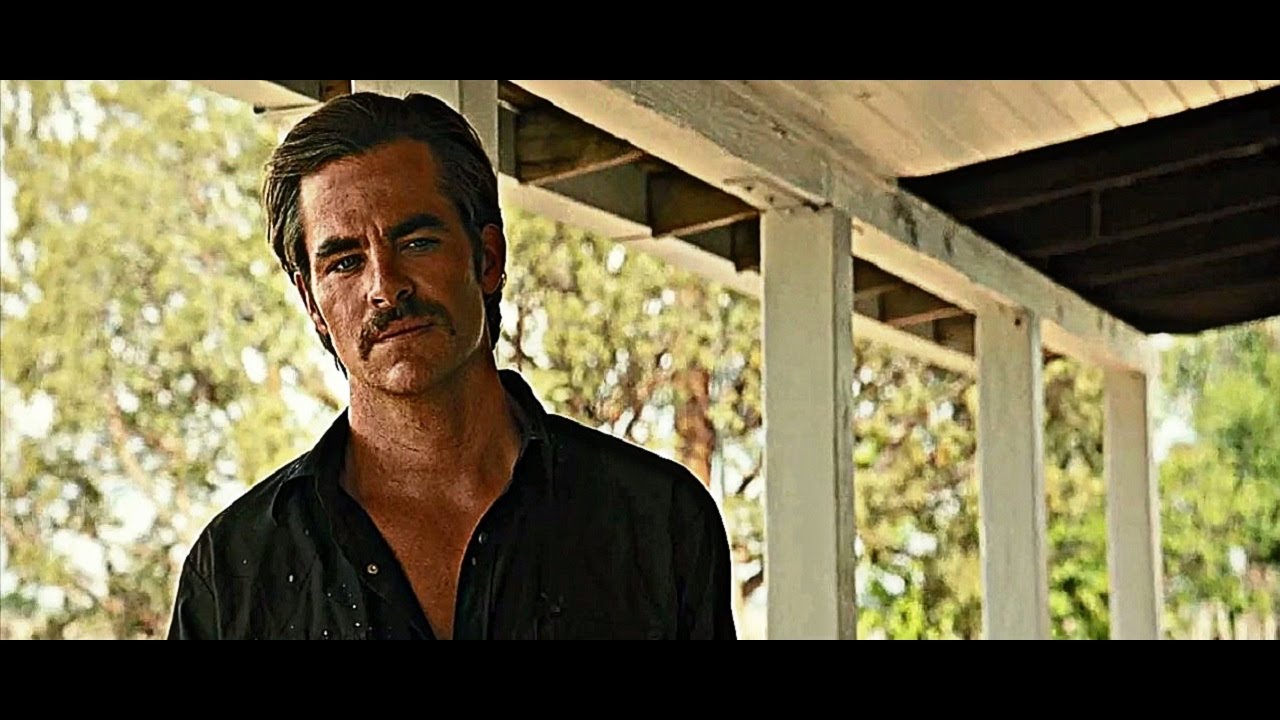

One of my favourite movie lines is from Hell or High Water. At the end of the film Toby attempts to justify the chaos he let loose:

I’ve been poor my whole life. So were my parents, their parents before them. It’s like a disease passing from generation to generation, becomes a sickness, that’s what it is. Infects every person you know, but not my boys, not anymore.

There’s the obvious literal meaning here about real poverty, but I’ve also thought this was useful in another context. There’s poverty and then there’s what you allow your mind to tell you is poverty. They’re a long way apart, but like real poverty, imagined poverty can become a disease. People think they’re worse than they are. They begin to act poor and become poor in spirit.

The disease has made them pursue an imaginary number, instead of just living their lives. When they aren’t reaching the imaginary number they’re stressed and miserable.

I assume years ago people didn’t necessarily give a crap about saving all the time (plenty don’t today), you probably saved what you could, independently of what a personal finance guru or some guy in reddit said was optimal. Sure the world was different, but it seems personal finance culture now has some people stressing out if they’re not hitting their marks on a spreadsheet each month.

This is only a moment in time. In a couple of years you both might be making more and the repayments are around what they are now or less, you can drop more into savings then.

Forget allowing percentages you box you in.

This represents general information only. Before making any financial or investment decisions, I suggest you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Don’t make financial or investment decisions on the basis of blog post or sourcing advice from internet forums, if you’d like a introduction to investing, please consider reading Your Investment Philosophy, which offers an evidence based primer for building your own investment philosophy.