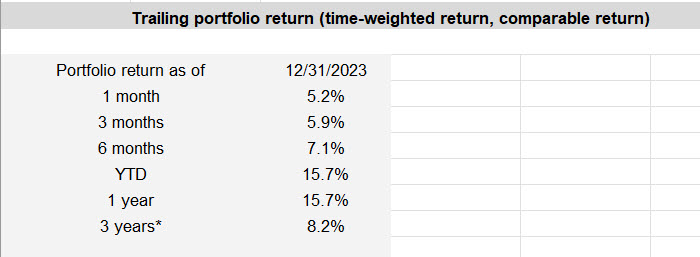

Month 42 and December on top of November was some turn around to cap off the year. I’ll take a 15.7% calendar year return any time. Initially I only added 0.66 of an original contribution at the start of the month, which went to global value.

Later in the month I had 3x the value of an original monthly contribution come in. I stock I’d held for quite a while was taken over. I felt it undervalued the company and it further complicated my holding as the company was taken over, while another part was spun off into another company who took a particular asset. I guess you could there was some emotion that came into it, I found myself disgusted with management of both companies. To me it seemed there was some collusion there. The MD of the company I owned formally worked for the company doing the acquiring. The guy had long been seen as a cuckoo in the nest, and rightly or wrongly, it played out that way.

Such things you never have to worry about with a broad index and factor based portfolio!

Anyway, I waited until I got almost the best price I could and sold on market. I left 60% in my savings account and sent the other 40% to this portfolio. The funds were split between Australian REITs, Emerging Markets, Global Small and Global Large.

One of the interesting things about the performance of global large caps, basically driven by tech stocks in the US, is if you’re keeping the weightings in your portfolio stable by ongoing contributions, global large almost never gives you a chance to add money. I looked back and the last time I allocated any money to global large was in April. If it goes up while other asset classes do nothing, the new money can only go to those asset classes because they’re falling behind.

Until next month, stay disciplined!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. If you’re looking for a financial adviser, you should look to find a fiduciary in Australia who can assess your goals, and find the right portfolio to help you achieve them.