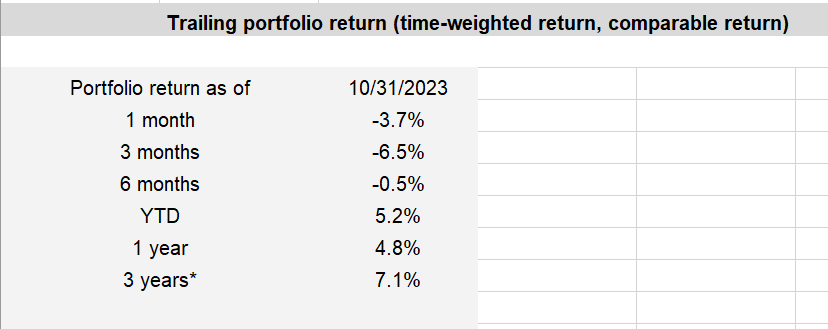

October was a rough month. Down 3.7%. Anyway first trading day of the month I allocated a 0.83 of an originally intended contribution to global value. It was also a distributions month, so when those hit the account in the second half of the month they were invested in global infrastructure. I don’t reinvest distributions where they came from as I don’t have auto reinvest switched on. For me it’s just an opportunity to direct money to one area it might be needed.

This was the second stinker month in a row. It dragged overall performance down. The since inception number isn’t highlighted, but it’s 3.6%, which ain’t great but shows how quickly things can either deteriorate or improve in a couple of months.

If you don’t keep ploughing money in during these periods you’re unlikely to enjoy higher returns in the future. That’s what the discipline project is about.

I’m still allocating on a reduced figure due to the car thoughts. Still haven’t decided that and probably won’t any time in the future. Looking at what’s available and what’s likely to be available in the future is another consideration. I’d probably prefer a hybrid, but the car I’m most interested in has what might be termed a fake hybrid. It costs probably $6k more, and barely offers any fuel savings. Apparently they have a full version coming in next year’s model.

Until next month!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them. If you are looking for the best financial advisor in Canberra, then you should consider an adviser who can help you manage your wealth efficiently and offer a reliable strategy to follow.