First action of the new year was sending 0.83 of an originally intended contribution to the account and buying Australian high yield.

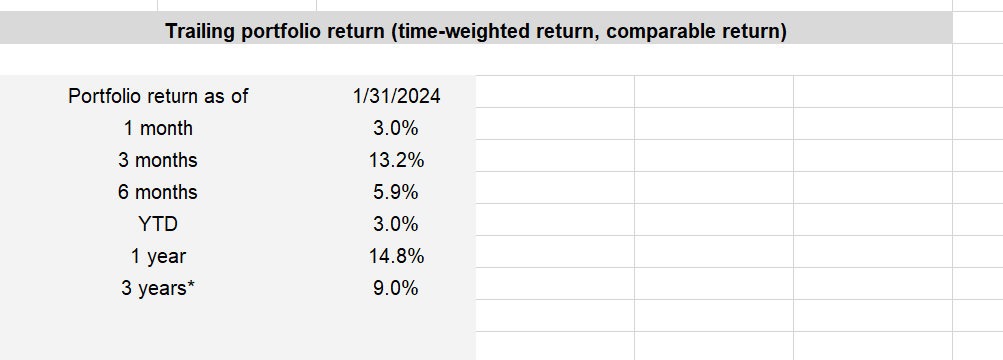

At this point I should note I’m well ahead of progress toward my 10 year target, based on a 7% pa return, so I’ll just say sent a contribution over. Currently I’m just over 13 months ahead of schedule of where I wanted to be at this point, but markets have been favourable and I’ve had extra money available along the way. Things are tracking better than expected.

It has been a nice turnaround after a consistent selloff during September and October of 2023. It’s been a straight shoot upwards since, which also poses its own discipline problems. When you think things have gone up too much, you get a little gunshy about allocating more money, especially when you’re not holding fixed interest in the portfolio.

Given I allocated to Australian high yield shares this month, I’d noticed an ongoing disparity between it and the ASX 300 index. Now you’d expect it, but you’d expect the bias to be towards the ASX 300, but over the past 1, 3 and 5 year periods the outperformance is coming from high yield, and not just because of income, the outperformance is mostly related to growth.

I could only speculate on why. Maybe because large caps are doing better at the moment and there’s too much garbage that floats in and out of the ASX 300. If you look at the Dimensional Australia Small Index it’s underperforming the ASX 300 and ASX 200 by a wide margin, like almost 4%pa over the past 5 years. Though it’s slightly ahead over the past ten years.

How long this will persist, I don’t know and maybe ignorance is bliss because I have about 18% of the portfolio in global small and I don’t know most of the companies so I can’t say whether they’re quality or not (they probably aren’t), but when I look at an Australian small cap index I see a hell of a lot of junk in there, which is why I don’t bother with Australian small.

Until next month, stay disciplined!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. If you’re looking for a financial adviser, you should look to find a fiduciary in Australia who can assess your goals, and find the right portfolio to help you achieve them.