Month 29 of the discipline project and it was a nice month, if they could all be like that it would be an easy game. Sent the contribution early in the month, it may have actually been sent on the last day of October, but these days I waste no time.

As the platform I use has now removed trading costs (starts with a V, you probably know it), I split the 1x contribution between emerging markets and Australian REITS. It’s interesting how the changes at the platform have progressed.

They are a big global operator and I signed up in the first month they released the platform in Australia. Initially, it was a 0.2% platform fee and as I started from zero it wasn’t an issue, then a year later they removed the fee and moved to $9 a trade. I had been splitting contributions evenly, but not wanting to blow an extra $18 a month, I cycled through the funds each month. Now it’s no platform fee and no trades, but I think I’ll keep it simple for the most part and restrict it to one buy per month.

Last month was an exception, emerging markets and Australian REITs are the two smallest holdings, with good reason, as they are the most volatile. I didn’t want to overweight them, so splitting a contribution kept them around 10% combined of the portfolio.

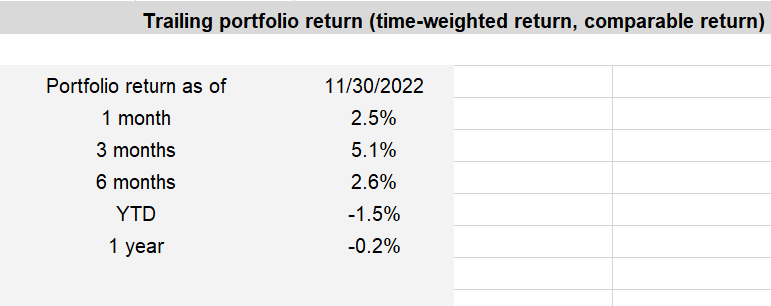

Here’s how things stand according to the boggleheads spreadsheet.

I can’t complain with that. After inflation it’s not great, but others have taken it in the teeth harder than me. As I’ve said, branching out into global value and using Australian high yield stock index offered a little bit more protection as broader indexes were bashed. I’m not going to call it a wise decision, nothing worse than people talking about how they got it right after the fact. I always believed in higher expected returns from value, and I didn’t want to be holding bonds at the bottom of an interest rate cycle, so I made a substitution that came with an expectation of higher yield.

So far it worked out, it certainly wasn’t due to my judiciousness.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them, if you are seeking financial advice then you should consider one of Australia’s best financial advisors who may be able to help you identify your goals and put in place a reliable strategy to pursue them.