This one’s a bit late, but it’s month 35, and when they’re late it reminds you “oh that was a poor month, but I’ve long forgotten about it and it the scheme of things, it doesn’t matter.”

According to my account I sent 1x contribution on the first day of the month and made the buy(s) that day. Split 50/50 between global value and Australian high yield. I also had half a contribution sitting in cash, which I allocated to global infrastructure. The product provider said they were cutting the interest on the cash part of the account, so there’s no point leaving anything but a tiny amount of cash in the account.

Looking for a financial adviser in Canberra?

Slightly annoying, but I get it’s in their interest to push people towards their cash like managed fund, but I’ve never really understood the point of a money market fund. Being required to do an in and out transaction to hold a cash like product you’re charged a fee on, is ridiculous to me.

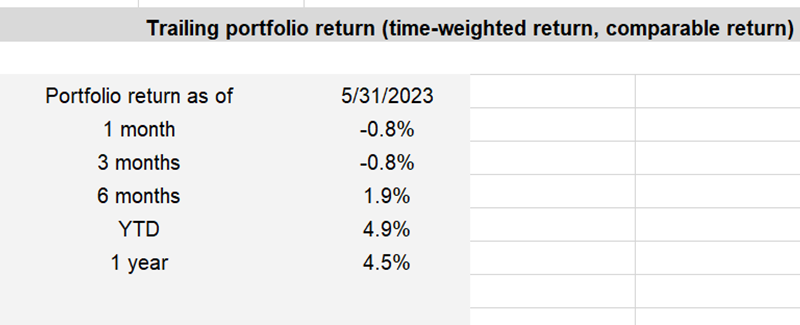

As far as the returns, the first of May was the high point for the month. I guess that’s something to consider in the future. When investing in an environment when interest rates are likely to move, early month transactions might result in a swift kick in the nuts! However, I’m not trying to second guess markets, so I’ll just keep doing what I’m doing.

Until next month.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them. If you are looking for financial advice in Canberra area, then you should consider an adviser who can help you manage your wealth efficiently and offer a reliable strategy to follow.