Three years down!

Same old, same old for the month. Made the contribution early and moved on with life. The contribution was split in Australian REITs and Australian high yield.

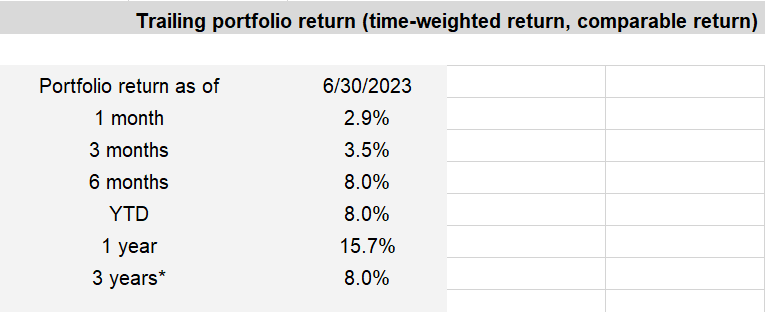

Performance for the month was obviously good, but we have reached something of a milestone here, three years of contributions and a visible 3 year performance figure. The one year figure obviously looks good, off the top of my head it’s ballpark for a similar risk level, it might be slightly under.

To me the important one is the 3 year figure. When I started this, I thought if I could get 7% pa that gets me to my target, when that return is combined with my intended savings rate.

Looking for a financial adviser in Canberra?

It is a bit lower because in the first 18 months I had a 33% allocation to fixed interest. Now I got out before the fixed interest wipeout of 2022, but that fixed interest allocation was mostly stagnant and had started to decline before my exit. 33% of your portfolio spraying the bowl for 18 months is quite the performance drag. Had I been running the current construction, I’d be looking at much higher return.

Not that it matters because the point is I’m ahead of my own measurement. I don’t care about what anyone else is getting or whether I’m beating a benchmark because the only benchmark that counts when investing is my own goal.

The questions for every investor and they don’t revolve specifically around performance.

Am I on target to reach my goal?

Will my portfolio sustain my spending goals?

These are really the only two questions that matter when investing.

Performance is stats, the final score is what matters.

And the final score is getting the performance that allows you to live the life you want.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them. If you are looking for financial advice in Canberra, then you should consider an adviser who can help you manage your wealth efficiently and offer a reliable strategy to follow.