Three years and a month. Only 0.16 of a contribution this month because I had a tax bill to pay from last year. Unfortunately, it was a pretty good month and distributions came through, so with a meager contribution and distributions not appearing until after the 18th I didn’t get any money into the market until later in the month.

I put the contribution and distributions into global small.

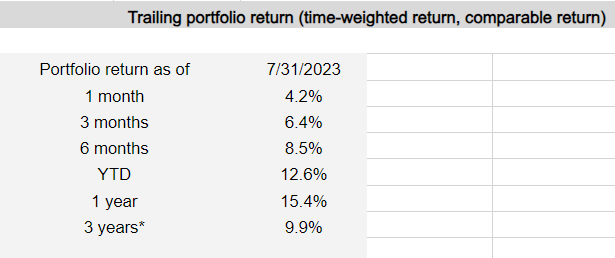

As the returns table shows below, it’s been a pretty good year so far. Up double digits, despite interest rate increases the market has been almost unrelenting across the board. Which makes you start to wonder: when’s the correction coming? There were small sell offs in March, May and at the end of June, but otherwise most charts look like straight lines up.

Looking for a Canberra financial adviser?

The big concern is now I have three years of contributions and a decent amount of growth in the portfolio, a 10% correction hurts now a lot more than when the portfolio was a lot smaller. One of the things this also highlights is there is no where to hide whether you’re dollar cost average or lump sum investing. Sooner or later you’re going to have a lot of your money exposed to the market, whether that’s immediately, or in 12, 24, 36, 48 or 60 months time.

I also know any sell off from here will hurt a little more, as I’m likely dialing contributions back over the next year. Life occasionally intersects with investing and I was thinking about updating my car. It will mean pulling back to 0.66 contributions. I’d like to continue ploughing on, but I can afford a breather as I’ve made some extra contributions and returns are higher than I forecast. Currently the portfolio value, at month 37, is sitting where I’d forecast it to be in month 48 or 49.

If the market does go down the frustration is I won’t be socking as much into it, but as I said, life occasionally intersects with investing. It could have been worse, I could have listened to everyone who thought the market was heading for a rout over the past year, jammed by money in a high interest savings account and missed out on a double digit return.

Until next month.

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them. If you are looking for financial advice in Canberra, then you should consider an adviser who can help you manage your wealth efficiently and offer a reliable strategy to follow.