September 2023 done and dusted, being month 39. Still haven’t decided on the car, so 0.83 of the originally intended contribution, with 60% of it going to global value and 40% of it going to global infrastructure.

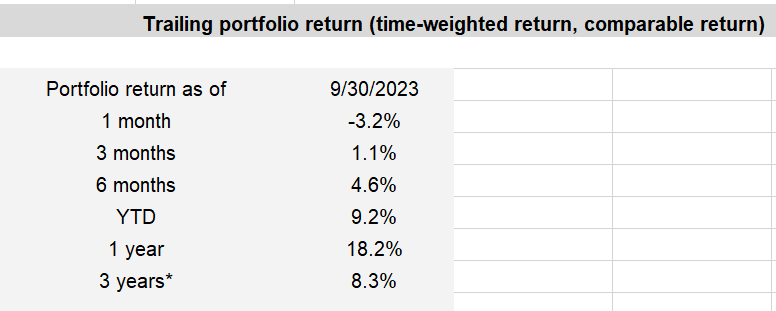

Wasn’t a great month clearly and global infrastructure was royally kicked in the nuts, all of it in the last week of the month. Together global infrastructure, emerging markets and Australian REITs float between 12-15% of the portfolio, so it’s not a massive issue.

What’s interesting is looking at a dollar growth chart over the whole timeframe. I won’t post as it shows the dollar value of the portfolio, but since July 20 the portfolio has only gone down in dollar terms three times previously. June 22, September 22 and December 22. September 23 makes it four.

As I’ve mentioned in previous updates, considerations around a car have started to weigh. Throughout this project you might say I’ve been running with what might be considered an abnormally high savings rate. Roughly a full monthly contribution is about 69% of my monthly income. Adjusting to changing something that you were doing religiously for three straight years is actually quite hard.

You end up wringing your hands and rechecking what your portfolio growth might look like and a, b and c contribution scenarios. It probably tells me I should pull back slightly and relax!

Until next month!

Disclaimer: The discipline project is a personal endeavour and should not be constituted as a financial strategy that anyone should follow. It is more a study in repetition and shutting out the noise in pursuing a financial goal, than any focus on portfolio construction. Anyone looking to build a portfolio should seek financial advice to find out which strategy is right for them. If you are looking for financial advisor in Canberra, then you should consider an adviser who can help you manage your wealth efficiently and offer a reliable strategy to follow.